Bonds Could Be Getting Replaced by A Better Alternative

For decades, investors have leaned on the traditional 60% stock and 40% bond portfolio (60/40 for short).

For good reason.

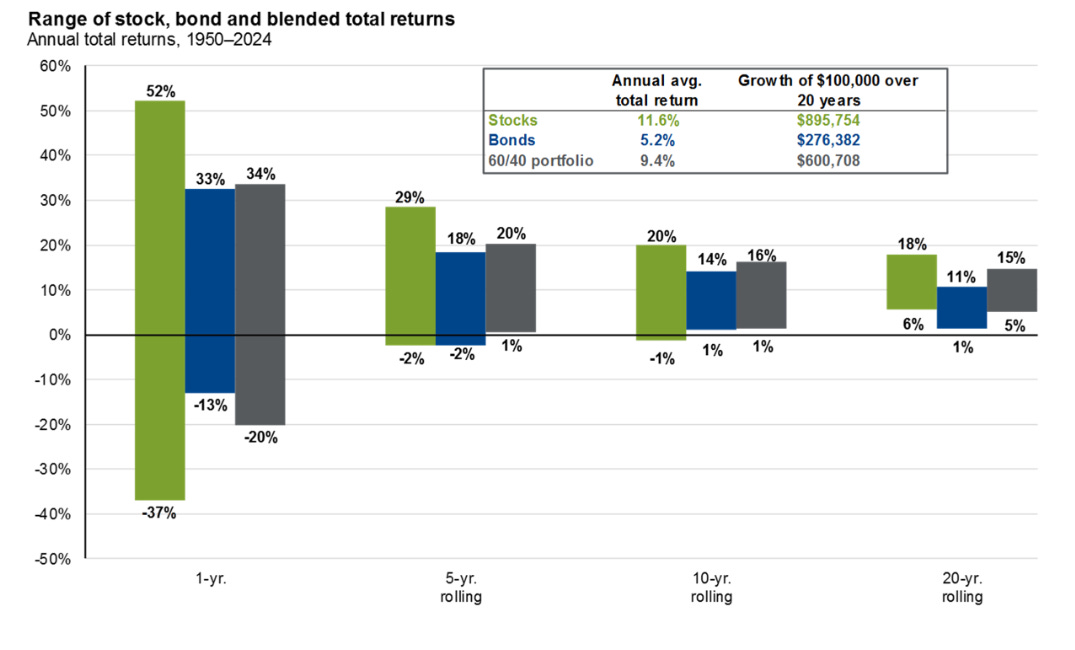

JP Morgan’s Guide to the Markets shows that a 60/40 portfolio has historically delivered slightly lower returns to an all-stock portfolio but with much less volatility, making it a cornerstone strategy for many institutions and individuals.

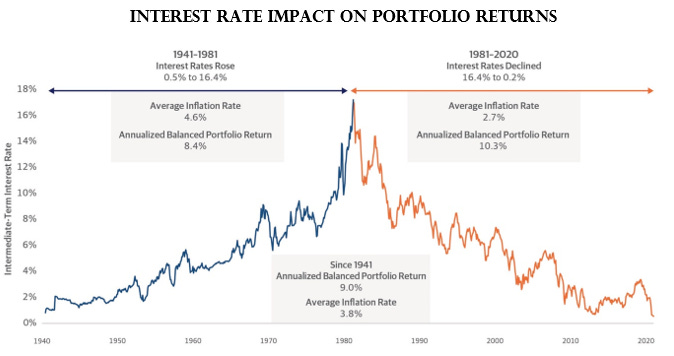

One big reason it worked so well is because bonds enjoyed a nearly 40-year uninterrupted bull market.

Northwestern Mutual shows that the 40-year period before 1981, a 60/40 portfolio earned 8.4% annualized, while the following 40-year period produced an impressive 10.3% annualized return (see chart below):

Those outsized bond returns were fueled by steadily falling interest rates.

When interest rates fall, bond prices rise.

But times have changed.

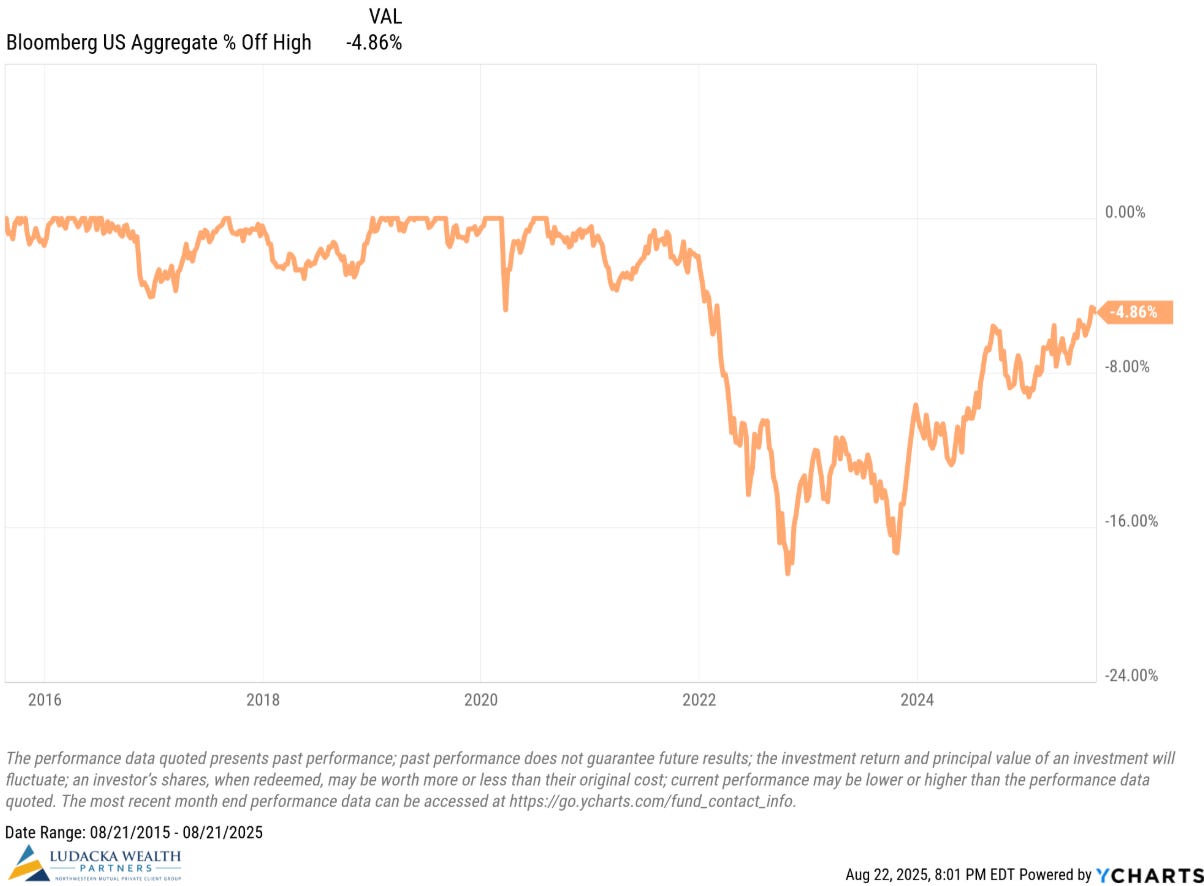

Interest rates spiked between 2021 and 2023, driving bond prices down almost 18%.

They still haven’t completely recovered from the fall (see chart below):

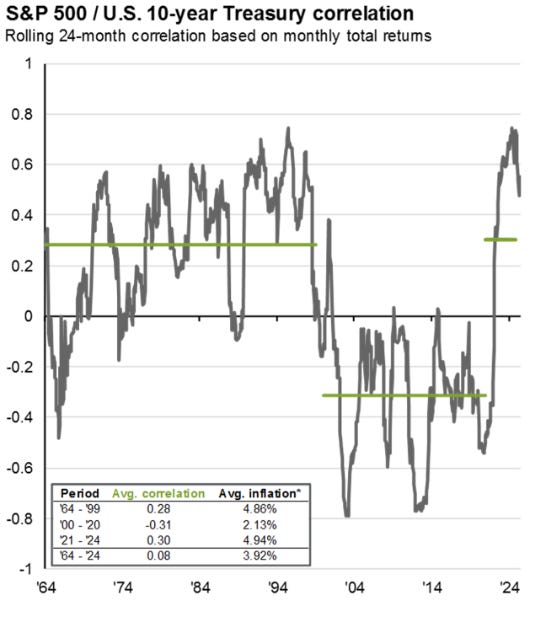

To make matters worse, bonds have struggled to buffer portfolios from stock market falls as much as they did in the past.

The 20-years before 2020, bonds tended to zig when stocks zagged.

In investment nerd terms, they had a low correlation to stocks. The lower the correlation, the greater the diversification benefits.

However, over the last four years, bonds and stocks have often moved together.

With bonds delivering weaker returns and less diversification, investors have naturally turned to other options.

Enter Alternatives1

Private equity, private credit, private infrastructure, private real estate, and hedge funds are examples of alternatives.

Some have been drawing increased attention due to their growing size and regulatory changes, especially the White House opening the door for 401(k) participants to access these investments.

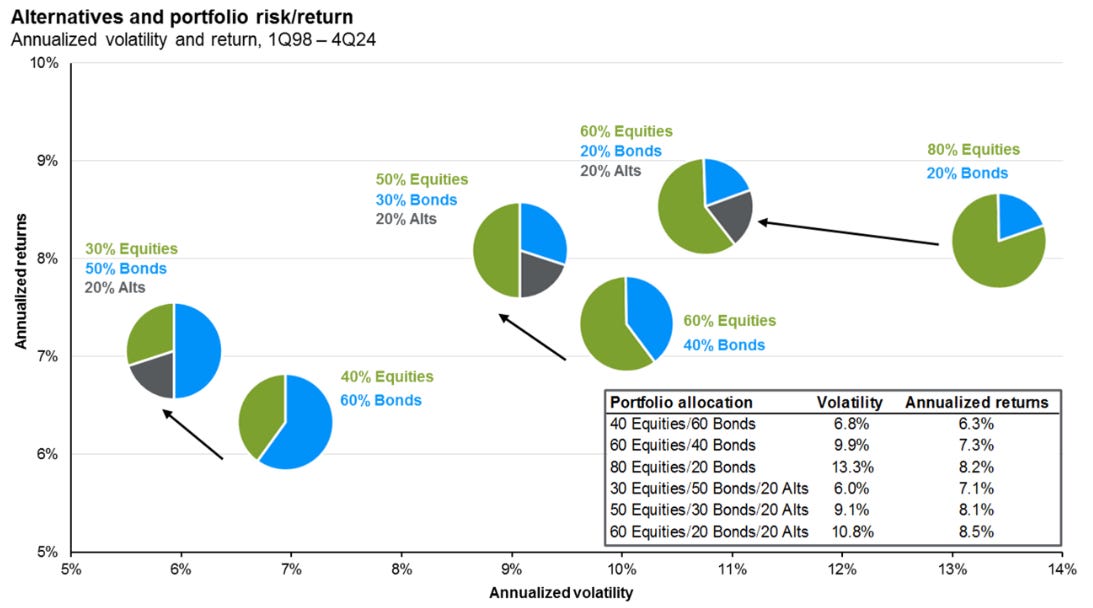

Historically, adding certain alternatives to a portfolio has provided slightly higher returns with lower volatility than a typical 60/40 portfolio (see chart below):

As with any new investment, investors need to understand the risks1 and trade-offs of alternative investments.

Four Tradeoffs To Know

Diversification Benefits Vary

Not all alternatives diversify equally.

Real estate, infrastructure, timberland, and certain hedge fund strategies can help smooth portfolio swings.

Private equity, however, moves more closely with public equities. So, while it may boost returns, it won’t provide much cushion when public stocks fall.

Returns Can Vary Widely

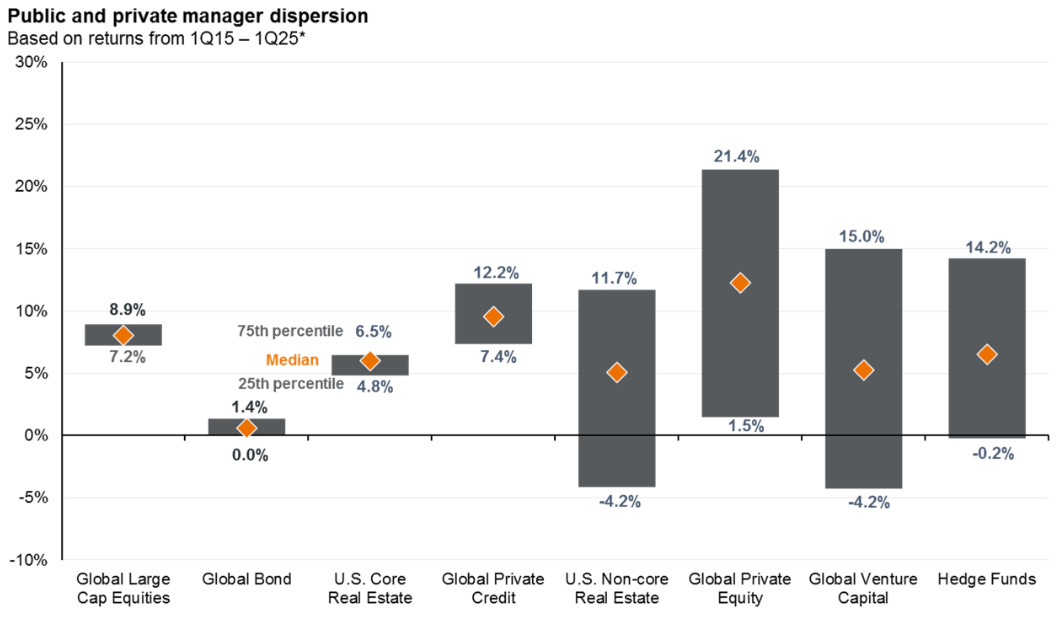

The gap between the best and worst managers can be huge.

Over the last decade, the top private equity firms outperformed the worst by nearly 20% annualized IRR (internal rate of return).

The Basics: I’m not the biggest fan of IRRs. While common, IRRs might not tell the entire performance story of a fund. IRRs reflect both the size and timing of cash flows. An early sale of one winning investment can inflate IRR even if the rest of the portfolio lags. It’s like getting part of your paycheck early but waiting a long time for the rest. The total is what really matters.

The return gap for venture capital and hedge funds is just as stark.

So, manager selection matters, more so than other asset classes.

Volatility Can be Masked

Private investment returns could appear smoother than those of public markets because private stocks are only valued a few times a year, not priced every day like public stocks.

The limited reporting smooths out the bumps, even though private businesses face the same risks and swings as public companies.

The result is that private investments can appear less volatile than they really are.

Less liquidity

One of the biggest trade-offs in private investing is liquidity.

Public stocks can be sold instantly, while private investments often lock up money for years.

Some private investments allow quarterly withdrawals but may cap how much you can redeem.

The illiquidity can pay off, but it requires patience and planning.

Final Thoughts

Bonds remain a vital part of most portfolios.

With higher rates staying higher (or more normal) than expected (although Jay Powell’s comments on Friday could signal a slight decrease in rates in September) and weaker diversification benefits, investors are exploring alternatives.

Alternatives can play a valuable role in portfolios but are not without risks.

Prudently adding them to a diversified portfolio can add the benefits investors are seeking.

Keep learning. Keep growing. Keep going.

Endnotes:

1: Alternative Investment Products involve unique risks and are not suitable for all clients. Among other things, alternative investments risks may include: leverage and other speculative investment practices that may increase the risk of loss; illiquid investments with long holding periods; restrictions on transferring interests; lack of periodic pricing or valuation information; complex tax structures and delays in distributing important tax information; investing in foreign markets which may entail risks that differ from those associated with investments in U.S. markets; higher fees which may offset trading profits; and in many cases the underlying investments are not transparent and are known only to the investment manager. Typically, clients must meet the Accredited Investor, Qualified Client, and/or Qualified Purchaser requirements, as defined under Securities and Exchange Commission ("SEC") regulations, to participate in these offerings, as required by the issuer of the investment. An Accredited Investor is an individual whose net worth, or joint net worth with his or her spouse, presently exceeds $1,000,000, exclusive of the value of his or her primary residence, an individual who had income of more than $200,000 or joint income with the individual’s spouse or partner more than $300,000 in each of the two prior years, and a corporation, partnership, LLC, trust, or non-profit organization with total assets of more than $5 million. A Qualified Purchaser is a person whose investable assets are greater than $5,000,000, a trust managed by Qualified Purchasers, or an entity which owns and invests at least $25,000,000. A Qualified Client is an individual with a net worth of more than $2.2 million, either by themselves or jointly with a spouse, excluding the value of their primary residence. Eligible investors should be financially sophisticated with sufficient knowledge and experience to evaluate the merits and risks of the investment and able to understand and sustain the risk of loss.

Now here’s what I’ve been reading, listening, and watching:

Andy Grove (the Hungarian who escaped from Nazis and Communism to become the 3rd CEO of Intel) on Founders

Walt Disney (the making of Disneyland) on Founders

The 5 Types of Wealth by Sahil Bloom

Children’s book (I have a 5-year old): The Best by Brody Kelley

Here’s what I’ve been writing: