The First Deal Is the Hardest

The first $100,000 is a BLEEP, but you gotta do it. I don't care what you have to do – if it means walking everywhere and not eating anything that wasn't purchased with a coupon, find a way to get your hands on $100,000. After that, you can ease off the gas a little bit.

– Charlie Munger

The Trump Administration announced its first trade deal with the United Kingdom last week.

The U.S. stock market rejoiced by rallying nearly 2% on the news.

Here are the key points from the deal:

Faster customs clearance for U.S. goods headed to the UK, especially in agriculture, chemicals, energy, and industrials.

Tariff updates: While the 10% baseline tariff remains in place, specific high-tariff items like autos (previously 27.5%) now fall under the 10% umbrella but only for the first 100,000 units, which matches what the UK exported to the U.S. last year.

Pharmaceutical cooperation to shore up the supply chain.

Steel and aluminum: UK exports of these metals to the U.S. won’t face tariffs.

Big-ticket purchase: The UK committed to buying $10 billion worth of Boeing planes. Rolls-Royce engines (used in Boeing Dreamliners) will also be tariff-free.

Many details have yet to be finalized. Trade agreements take a long time to complete.

However, it’s one small step for the Trump administration to accelerate its trade agreement strategy and one giant leap to remove global tariff uncertainty.

A Real Rally or a Bear Rally

Given the stock market’s behavior over the last 30 days, it might be expecting more deals to be announced sooner rather than later.

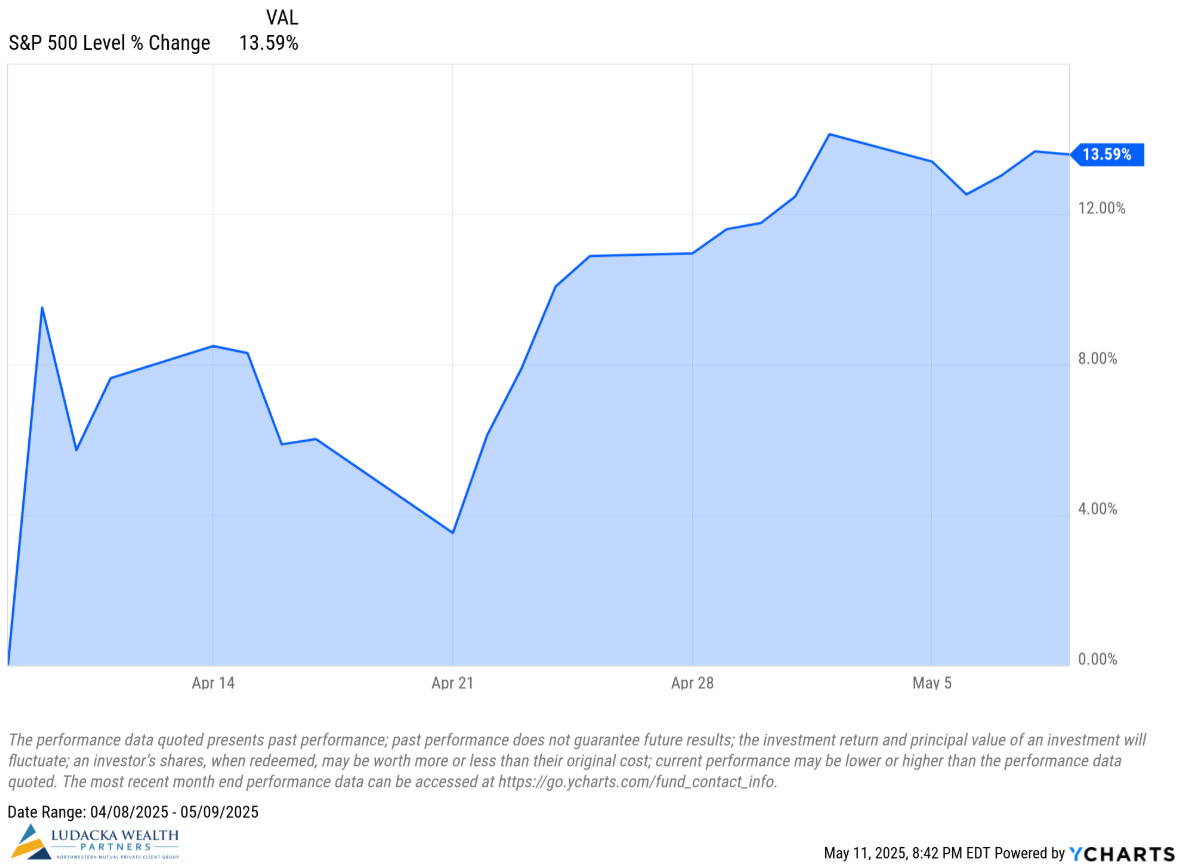

Since the April 8th bottom, the U.S. stock market has jumped by over 13% (see chart below).

Could this be a bear market rally?

The Basics: A bear market rally is like a short break in a losing game. When the stock market is down more than 20%, that’s a bear market. If the market suddenly starts going up for a little bit but falls back down, that’s a bear market rally.

Sure.

For historical context, during the dotcom bubble, there were 10 bear market rallies of at least 5% gains (dark blue lines below) – none were sustainable.

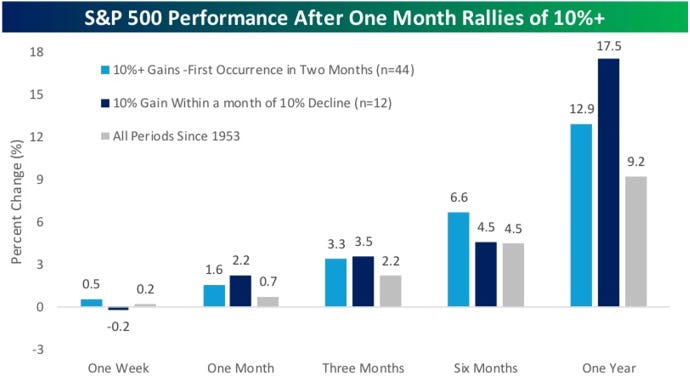

However, Bespoke Investment Group found the odds of achieving above-average performance after a 10% rally can be sustainable:

Looking at all 10%+ gains in a month (with no prior occurrences in the last two months), the S&P 500’s median forward returns were better than the long-term average for all periods since 1953 (light blue bars below):

Looking at 10%+ rallies that occurred within a month of a 10%+ decline (e.g., April 2025), forward returns were also generally better than the long-term average for all periods, except for the one-week period (dark blue bars below):

The stock market’s positive momentum has spilled into the first quarter’s earnings calls.

Since April 10, over 1,500 companies have released earnings.

5% of companies lowered guidance, which was expected given the sky-high uncertainty around tariffs.

However, 6% of companies actually raised guidance.

Here’s Bespoke Investment Group again:

In terms of guidance, no one (present company included) expected any company’s management in their right mind to raise guidance given all the “uncertainty.” There simply wasn’t any incentive. Well, 6% of management teams must be crazy because that’s how many raised guidance, which exceeded the 5% of companies that lowered guidance. Imagine heading into an earnings reporting period where tariff rates were lifted to the highest level since the Great Depression, and more companies still raised guidance than lowered guidance.

Final Thoughts

The U.S. has been in talks with many countries to update trade agreements, the biggest and most consequential of which is arguably China.

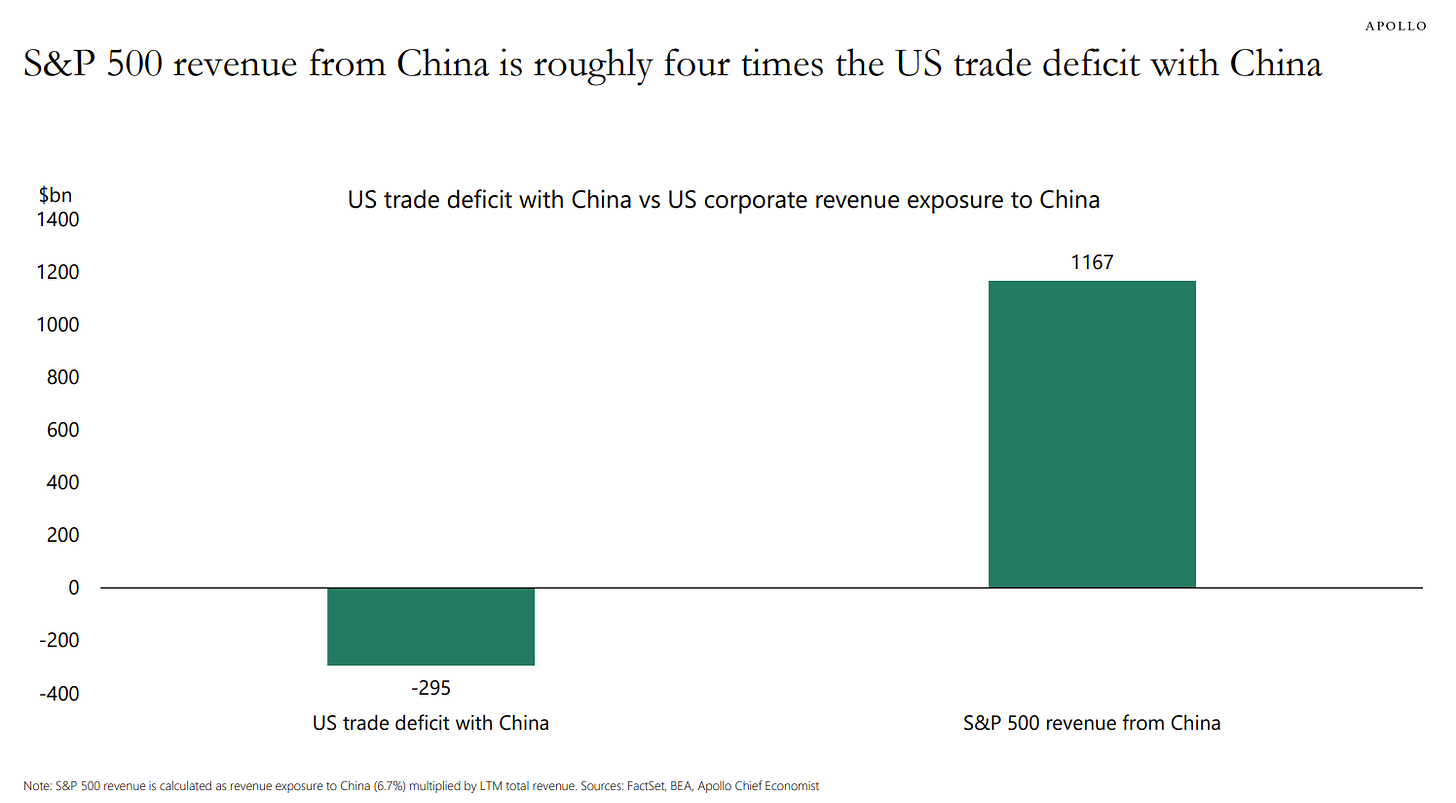

If that deal comes, it will have serious implications. U.S. companies have a deep footprint in China.

Here’s Apollo Chief Economist Torsten Sløk on the topic:

Calculations from FactSet’s Geographic Revenue Exposure Database show that China makes up about 7% of the total annual revenue in S&P 500 companies. Comparing the magnitude of the trade deficit with the revenue generated by S&P 500 companies in China shows that US companies made $1.2 trillion in revenue selling to Chinese consumers, about four times more than the size of the trade deficit in goods between China and the US, see chart below.

Every new deal adds clarity, and that’s the world’s most valuable currency right now.

This first step with the UK may not be the major deal, but it could be the spark that lights the fuse.

As Charlie Munger said, the first $100K is the hardest. Once you break through, momentum starts working in your favor.

Time will tell if this was a dead end or the start of a chain reaction.

Note: As of Monday morning, there was a “trade truce” between China and the U.S. and the market are happy.

Now here’s what I’ve been reading, listening, and watching:

Joseph Pulitzer (the man who transformed newspaper consumption) on Founders

Estée Lauder (who gifted her products and made tell-a-woman her success story) on Founders

Just Keep Buying by Nick Maggiulli

The Seven Frequencies of Communication by Erwin Raphael McManus

The 5 Types of Wealth by Sahil Bloom

Children’s book (I have a 5-year old): Spanish Habbi Habbi Books

Here’s what I’ve been writing: