The Stock Market Sees The Future

Difficult to see. Always in motion is the future.

– Yoda in Star Wars: The Empire Strikes Back

The stock market is the closest we’ll get to a real-life fortune teller.

It deals with uncertainty, prediction, and the human desire for clarity about the future.

It suggests it can see upcoming opportunities or dangers that others overlook.

However, the stock market is not lodged in a creepy strip mall for only a few to encounter.

It is out in the open for all to experience.

And in that experience, is a market that is already pricing in tomorrow’s reality.

The Seduction of Sirens

Have you heard of the Greek hero Odysseus?

Homer wrote about him in the 7th or 8th century BCE.

The tale goes that he and his crew encountered the island of the Sirens, where dangerous creatures lured sailors to their deaths with their irresistible song.

Anyone who heard their voices would be enchanted, steering their ship into the rocks and perishing in the sea.

Odysseus wanted to hear the Sirens’ song without being lured to his doom.

Following the advice of the sorceress Circe, he devised a plan:

He ordered his men to plug their ears with beeswax so they wouldn’t be able to hear the Sirens’ song.

He instructed them to tie him to the mast of the ship and, no matter how much he begged or pleaded, not to release him.

As they sailed past the island, the Sirens sang their seductive song, promising knowledge and pleasure beyond imagination.

Odysseus, enchanted and desperate, struggled and begged, to be freed but his crew, deaf to the temptation, held fast to their duty.

Once they were safely past the island, the men untied him, and they continued their journey.

Much like the Sirens lured sailors into catastrophe, the sirens of negative economic headlines can tempt investors into short-term emotional decisions.

The Seduction of Danger

From talk of recession and tariff wars to airlines cutting first-quarter earnings guidance, the sirens of uncertainty the past couple of months have been irresistible.

We have heard from key business contacts, economists, and market experts by way of the Fed’s Beige Book Report on their feelings about the current economic conditions.

They are overwhelmingly mentioning tariffs, immigration, inflation, and uncertainty (see chart below – numbers represent the count for each word):

We have heard from Wall Street banks that the probability of a recession in the U.S. has increased:

JPMorgan Chase increased their likelihood of a recession from 30% to 40%

Goldman increased it from 15% to 20%

The Stock Market Carries On

Some believe the stock market will experience more pain in the near future, which is possible.

However, what if the stock market is already seeing past all of the present negative news?

Sam Ro of the TKer publication recently said:

Believe it or not, at a given moment, the stock market does not care too much about the present state of things. That’s because expectations for the present will have been priced into the market days, weeks, and months in the past.

The stock market usually begins to recover before the economy gets better.

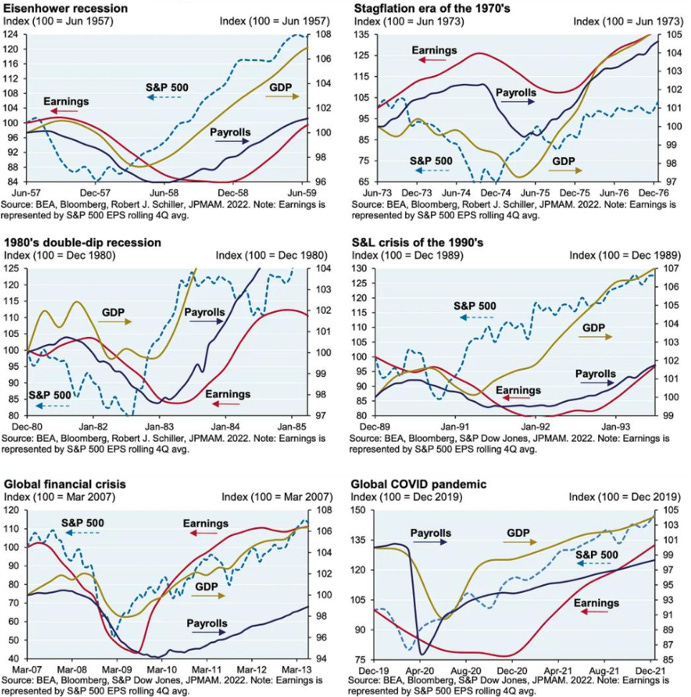

In 2022, JP Morgan’s Michael Cembalest looked at how the stock market fared before and after a slowdown in the U.S.:

A summary of the results:

The stock market (light blue, dotted line) bottomed about five months before the economy (yellow line) – sometimes it was a bit longer and others a bit shorter.

During the dot-com bubble, the market bottomed after the economy, which is rare.

This means is that you shouldn’t be surprised to see the stock market do better even when the current state of affairs does not look pretty.

Final Thoughts

No matter how crazy the world looks today, everything can change tomorrow.

My vote is to put beeswax (or ear plugs) in your ears and focus on what you can control: your risk, your time horizon, and your state of mind.

If you need someone to hold you down before you make an impulsive financial decision, let me know.

I’ll get the rope.

Now here’s what I’ve been reading, listening, and watching:

The story of Billy Durant (the car founder the world has forgotten) on Founders Podcast

The story of the Dodge Brothers (the inseparable car brothers who rivaled Henry Ford) on Founders Podcast

Just Keep Buying by Nick Maggiulli

One of favorite children’s book (I have a 5-year old): Am I Yours by Alex Latimer

Here’s what I’ve been writing: