To understand the real value of a financial advisor, we need to break down three essential truths:

Not everyone needs a financial advisor.

Financial advisors do more than just manage investments.

A good financial advisor provides real value.

Not Everyone Needs A Financial Advisor

I’m not into yoga. Don’t tell my wife.

But if I were, I would start with the basics – mountain pose and downward dog – before graduating to something fancier like camel pose and boat pose (yes, these are real names).

And if I really wanted to optimize my breathing, flexibility, and overall physical wellness, I’d hire a yoga instructor to guide me. Maybe then I’d finally pull off a scorpion pose without ending up in the ER.

I do CrossFit every morning (humble brag), and we incorporate some yoga.

I’ve learned enough to get by.

Enough to know that I don’t need a yoga instructor in my life.

The same logic applies to hiring a financial advisor.

Some individuals have learned enough about financial planning to get by like:

They maximize their 401(k) contributions and take advantage of their company match.

They stick to a budget.

They understand diversification.

Their financial situation is simple. They don’t have a complex tax situation, estate issues, or a business exit to navigate.

Most importantly, they have the time and energy to manage their finances themselves.

People start looking for a financial advisor when their financial picture becomes more complex, when they want to make sure they’re optimizing their finances, or, frankly, when they just don’t have the time or interest to navigate the ever-changing world of taxes and financial regulations.

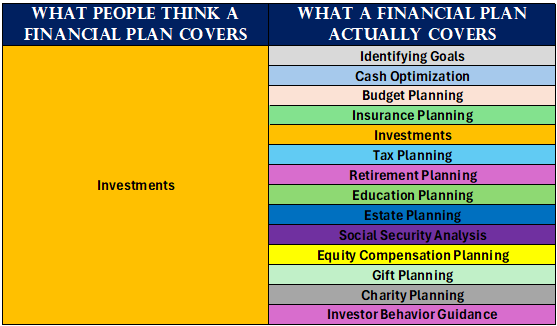

Financial Advisors Do More Than Just Manage Investments

A good financial advisor doesn’t just manage investments. They optimize a client’s entire financial life.

A good financial advisor helps:

Clarify financial goals - short, medium, and long-term.

Maximize opportunities in volatile markets (tax-loss harvesting and strategic rebalancing).

Minimize tax impact and create tax-efficient income streams.

Assess insurance needs - life, disability, long-term care.

Choose the best savings plan for kids (529s, UTMA/UGMA, Coverdell, or brokerage).

Work with CPAs, estate attorneys (e.g., wills, trusts, and wealth transfer strategies), and other professionals to create a seamless financial plan.

They help to accurately answer (as opposed to just Googling it) questions like:

Am I saving enough?

How do I create a budget?

What do I do now that I’ve sold my business?

How should I manage my stock options?

How much can I give to my grandchildren for gifting purposes?

Most people need more than just an investment portfolio; they need a clear strategy to achieve their financial goals.

A good financial advisor helps clients avoid costly financial mistakes, minimize tax impact, reduce stress, and give clients confidence in their future.

A Good Financial Advisor Provides Real Value

Full disclosure: I’m a partner at a financial planning practice, so of course, I believe in the value of financial advisors.

But don’t just take my word for it.

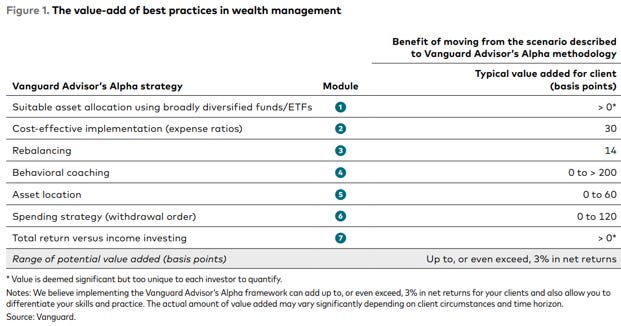

Vanguard – the second-largest investment manager in the world – released a study called Advisor’s Alpha in 2020, quantifying how much value an advisor adds.

They found that working with a financial advisor can add up to (or even exceed) 3% in additional net returns.

The 3% is not linear – it’s lumpy.

The biggest value often comes from behavioral coaching, which means an advisor helps clients stay the course when markets are euphoric or terrifying.

When markets are soaring, some investors abandon diversification to chase the latest fad of the day only to see those highfliers crash back to earth.

Only when the tide goes out do you discover who is swimming naked. - Warren Buffet

When markets plummet, fear takes over. Some investors panic-sell and move to cash.

The problem is magnified when these investors wait too long to get back into the market, usually losing out on the biggest gains.

A good advisor prevents emotional decision-making. They help clients stay disciplined, reassess risk, and focus on the financial outcomes the clients want to achieve.

Final Thoughts

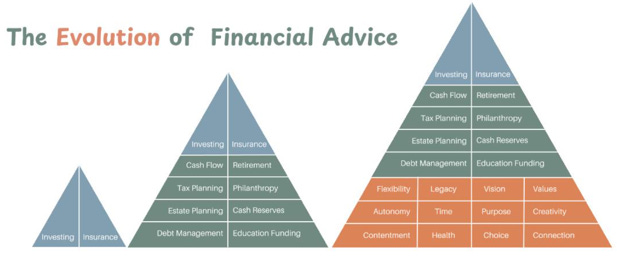

Financial advice evolves over time.

It starts simple with insurance and investments but then it becomes something more tailored to our financial aspirations (see illustration below):

I enjoyed Tim Mauer’s - author of Simple Money: A No-Nonsense Guide to Personal Finance - words on what good financial planning means:

Good financial planning may help you save a pile of money and spend it down before running out, but great financial planning gets to know us more and genuinely reflects who we are and what’s most important to us.

That’s the value a good financial advisor can provide.

Footnote:

1: Vanguard. June 2020. Putting a value on your value: Quantifying Vanguard Adviser’s Alpha

Now here’s what I’ve been reading and watching:

The story of Chung Ju-yung (from sleeping on bedbugs to founding Hyundai) on Founders Podcast

The story of Henry Ford (the man with one focus) on Founders Podcast

How To Know A Person by David Brooks

One of favorite children’s book (I have a 5-year old): The Boy Who Would be King by Ryan Holiday

Here’s what I’ve been writing:

I can't believe you're not into yoga!!!