To Diversify or Not To Diversify

“My ventures are not in one bottom trusted,

Nor to one place, nor is my whole estate

Upon the fortune of this present year.

Therefore, my merchandise makes me not sad.”

- The Merchant of Venice, Act I, Scene 1 -

The concept of diversification is as old as Shakespeare.

Even in the 16th century, most merchants knew better than to stake their entire fortune on a single ship or trade route.

The wisdom of spreading risk predates modern investing – it was a survival strategy for traders, explorers, and kings.

In investments, diversification means spreading risk across different assets classes (e.g., stocks, bonds, cash, and alternatives) so that not all your investments move in the same direction at the same time. In technical terms, we want to invest in something with low to negative correlation.

How many of you have stopped reading? 😊

Diversification is like the old saying: “Don't put all your eggs in one basket."

But it’s more than that – it’s also about choosing baskets that don’t all break at the same time.

When your investments are moving in the wrong direction or not moving as high as you want, you might question the idea of diversification altogether.

So, does diversification actually work?

The short answer is, yes - but it might take longer than you want.

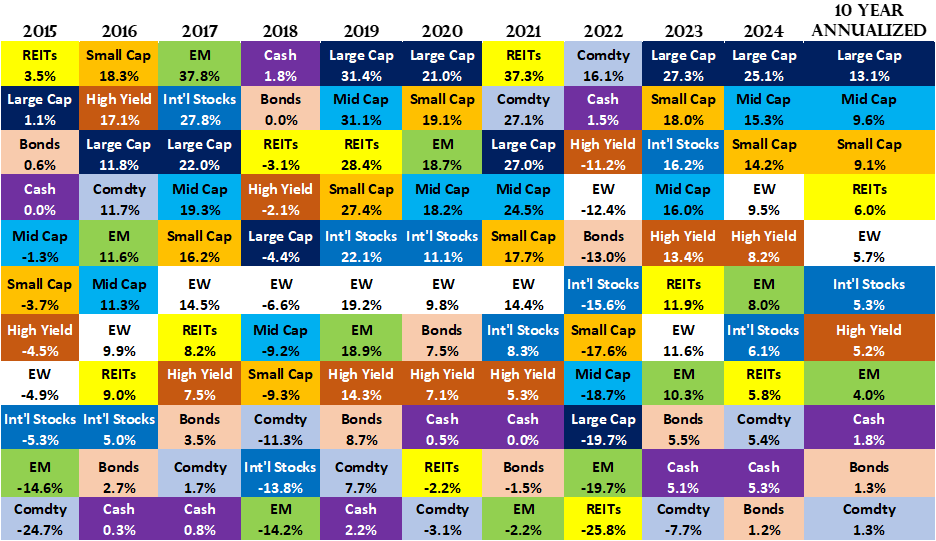

Below are the returns of different investments over the last decade (2015-2024) and their annualized returns (see column furthest to the right):

U.S. large companies dominated the leaderboard in 4 of the last 6 years and delivered the highest annualized returns.

Naturally, some investors believe they “knew” all along that the biggest U.S. companies would be the winners.

This is a classic example of hindsight bias, which is the tendency to view past events as more predictable than they really were.

“In the business world, the rearview mirror is always clearer than the windshield.”

Warren Buffett

We forget that these big companies weren’t always the cool kids at school.

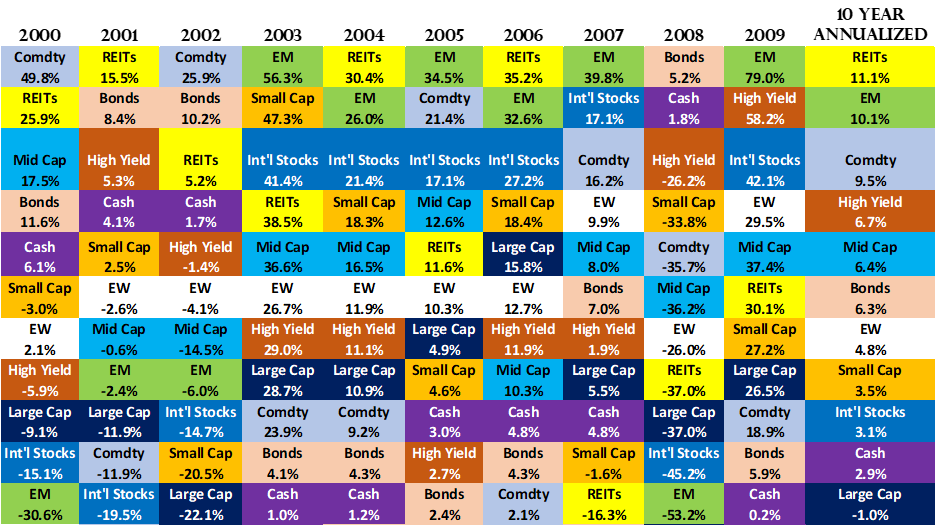

Below is the same chart but this time we’re looking at the time frame from 2000 to 2009:

Where are those U.S. large companies now?

If you squint your eyes, you can see them at the bottom of most years. In fact, these “juggernauts” delivered a negative 1% annualized return over this 10-year period.

All the data is in the past. All the value is in the future, and the future is unknowable.

Diversification means you will always hate something in your portfolio.

Diversification is not a get-rich-quick plan. It was never meant to be. It’s a stay-wealthy plan.

“I view diversification not only as a survival strategy, but as an aggressive strategy because the next windfall might come from a surprising place.”

Peter Bernstein

Diversification should help keep us invested.

Staying invested and enduring the ups and downs of the market, helps us achieve what Albert Einstein called the eighth wonder of the world: Compounding.

Now here’s what I’ve been reading and watching lately:

The story why people need to have a minimum level of stress by Morgan Housel

The story of the founder of Sony - Akio Morita - on Founders Podcast

The story of the man who beat Ferrari - Carroll Shelby - on Founders Podcast

Quiet: The Power of Introverts in a World That Can't Stop Talking by Susan Cain

My favorite children’s book so far (I have a 5-year old): High Five by Adam Rubin