When Will Interest Rates Fall?

I don’t know.

End of article.

Seriously, no one really knows.

Before we talk rate cuts, let’s start with the fundamentals.

“Gentlemen,” Vince Lombardi said, “this is a football.”

First, there are three main reasons why someone would hold bonds:

- Capital Preservation

- Income

- Diversification

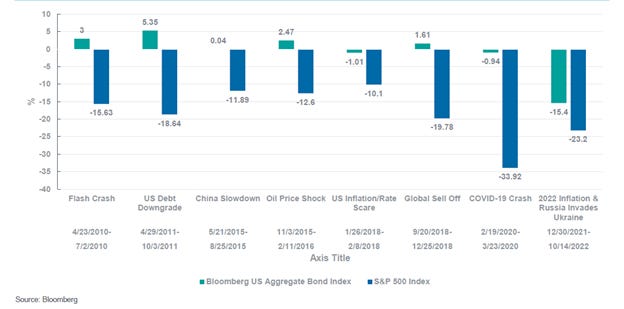

Historically, bonds have had fewer drawdowns relative to stocks.

Bonds have generally provided a positive return when the stock market has been experiencing a rough time.

The last bear market for stocks hurt bondholders more than usual because the Fed raised rates 11 times within about 16 months, which leads us to point 2.

When yields go up, bond prices go down.

The longer the duration (i.e., the number of years it takes to recoup a bond's true cost, based on the present value of all future coupon and principal payments), the bigger the effect on bond prices.

Bonds with shorter durations are not affected as much by changes in interest rates.

Third, a bond’s yield is the best predictor of return investors should expect when holding a bond.

About 90% of a bond’s total return comes from its yield.

As of January 22, the 5-year Treasury rate was yielding 4.43%, so current bondholders should expect to receive around this return after 5 years.

Now, let’s talk about today’s interest rate environment.

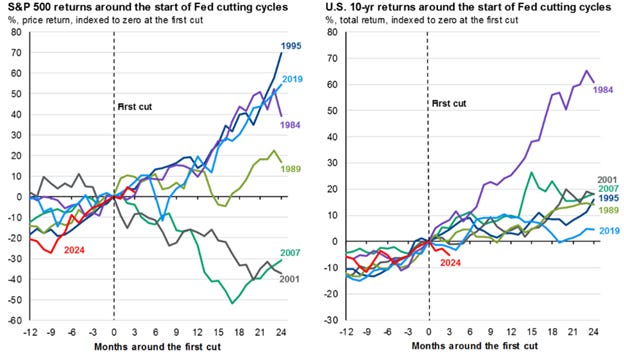

History has shown (albeit with a small sample size) that when the Fed first cuts interest rates, stocks turn out mixed over the next 12 to 24 months – four up years and two down years.

On the other hand, bonds have been shown to bat 1000 (i.e., a positive return) over 24 months after the Fed’s first cut.

So, buy bonds when the Fed cuts rates? Sounds easy enough.

>looking for my buzzer<

WRONG!

The black vertical line shows when the Fed first cut rates at their September 18 meeting. Since then, the 10-year Treasury rate has spiked by almost 1%.

Investors holding long-duration bonds are not happy right now. ☹

The FOMC (Federal Open Market Committee) decides when and by how much to change rates. Many members changed their expectations on the economy (i.e., many increased their GDP growth expectations in the coming years) and unemployment (i.e., many saw a decline in unemployment in the coming year) during their last gathering.

These updated thoughts by the FOMC made the market reel in the number of expected cuts in 2025.

In September, the market priced in almost 1.4% cuts in 2025. By the end of December, it was just expecting 0.40% cuts.

Summary:

Interest rates have risen, which has hurt bondholders in the near term.

Lesson:

Timing when interest rates will change is tough (dare I say impossible).

Want to sleep better at night?

Hold bonds for their true purpose: to preserve your wealth, increase your income, and diversify your portfolio.

You have enough things to worry about in your real life.

The direction of interest rates shouldn’t be one of them.