Why Am I Even Holding International Stocks?

Totally!

USA all the way!

It’s hard to deny that the U.S. has been the most prominent equity market in the world in recent memory.

As of January 1, 2025, the United States stock market was valued at $62.2 trillion.

Looking over the past two decades, no one comes close to the magnitude of the U.S. market (see tallest bar below):

America is in a different stratosphere.

Its equity market has grown by 300% in the past 22 years, four times larger than the next largest market, China!

The U.S.’s influence in global equities has increased by over 50% over the last ten years.

As of February 2025, the United States stock market made up 64% of all global equities, thanks to the very largest companies based here.

The U.S. market has had the wind on its back for the past decade, but it hasn’t always been this way.

Below, I show the best-performing developed countries per decade from 1970-2023:

Japan was a juggernaut in the 1970s and 1980s. Sweden performed wonderfully in the 1990s, and this is without IKEA in its stock market. Canada and Spain had a great run in the 2000s. We can find the USA at the bottom during this lost decade.

China’s performance is not shown above, but its rise from an agrarian economy to the world’s second-largest economy helped its stock market grow 3,300%+ between 2000 and 2022.

It’s just that this past decade, the U.S. has outshined and outlasted its international peers by a large margin.

For some of us, investing days feel like years, and the years feel like centuries.

It’s so hard to remember a time when international markets performed better than U.S. stocks.

But don’t you worry, my friend. I’m here to remind you.

The chart below shows when U.S. stocks outperformed international stocks in grey and when international outperformed the U.S. in purple:

It has been a tug-of-war between the two over the past 50+ years. It seems the U.S. has put a submission hold on international.

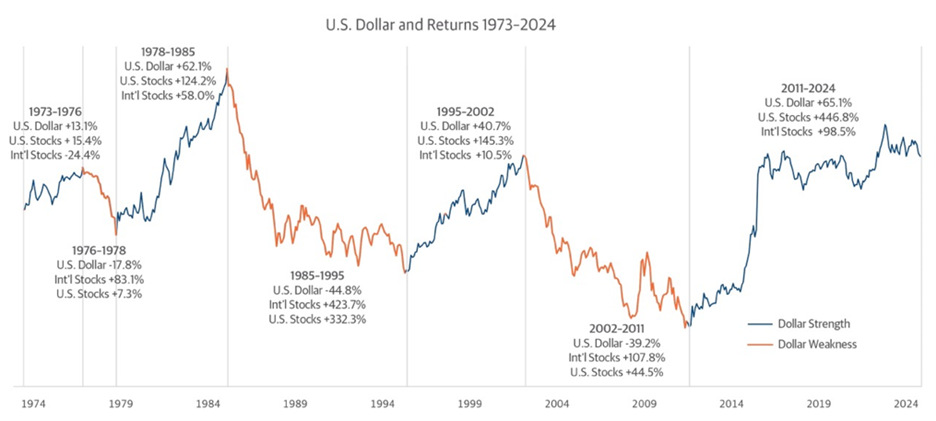

Currencies play a significant role in investment returns. A weakening domestic currency can bring down the value of returns, while a strong foreign currency can enhance them.

Below, we can see that during the time of U.S. dollar weakness (red line), international investments historically performed well.

A weakening dollar during the 1980s and 2000s helped propel international investments higher for U.S. investors.

Many of us suffer from “home country bias.” This bias means we over-invest in companies based on where we live because they feel more familiar to us.

However, on average, over half of the top 50 best-performing companies worldwide tend to be listed outside the U.S year after year.

This year, international stocks have outperformed U.S. stocks. I don’t know if this trend will continue.

Howard Marks, co-founder of Oaktree Capital, said it best:

You can’t predict. You can prepare.

Preparing to invest in international markets is not a bet against the U.S. or any other country – it’s about recognizing that the world is full of opportunities.

Now here’s what I’ve been reading and watching lately:

The story of Sol Price (his company merged with Costco) on Founders Podcast

The story of Les Schwab (Charlie Munger recommended this book) on Founders Podcast

All the different ways your life could have turned out by Morgan Housel

How To Know A Person by David Brooks

One of favorite children’s book (I have a 5-year old): The Rock From The Sky by Jon Klassen