What The ROTH Are You Talking About

Retirement accounts are the secret sauce to building a future in which work is optional rather than necessary.

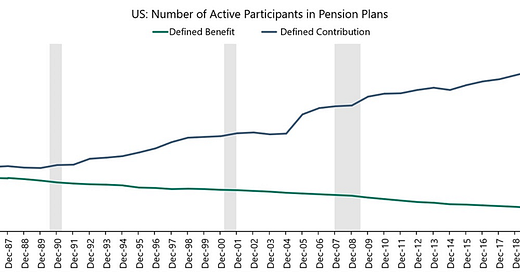

Most of us have to figure out how much to contribute to our retirement accounts (i.e., defined contribution plans) versus having our employers do the math for us (i.e., defined benefit plans).

The Basics:

A defined benefit plan (i.e., an employer pension) is like your mom’s promise that she’ll always have a set number of cookies for you even after you leave the house (i.e., retire from your employer). It’s mom’s responsibility to ensure you have enough cookies in the jar.

A defined contribution (i.e., a 401k or IRA) is more like a do-it-yourself cookie kit. You must pick the ingredients (i.e., investments) and how much to buy (i.e., how much to contribute to your retirement account).

As you can see from this chart from Apollo, the employer pension plan has been dying a slow death:

We have more choice than ever before which leads to more questions.

The financial world has an alphabet soup of abbreviations and jargon that most of us don’t use on a regular basis.

I’ll address a few of them below.

Taxable vs Pre-Tax vs ROTH

There are a few ways to contribute to your retirement savings (Note: I won’t cover annuities or life insurance in this post):

Taxable accounts: These are accounts that you open at a brokerage firm. Investment income, such as dividends or interest, is taxed in the year it's received, and capital gains are taxed in the year they're realized (i.e., when you sell).

Traditional pretax accounts: this is where contributions, plus any investment growth and income, are tax-deferred (i.e., you don’t pay taxes today) until the year you take out the money. Examples: traditional IRA and traditional 401(k)

ROTH accounts: this is where your contributions are taxed today, and any growth and income are tax-free for qualified withdrawals. Examples: ROTH IRA and ROTH 401(k)

I’ll focus on ROTH accounts for this post.

The ROTH IRA

With a ROTH IRA, you contribute after-tax dollars—meaning there’s no immediate tax break—but in return, your money grows tax-free, and qualified withdrawals are completely tax-free.

The pros of a ROTH IRA:

No taxes on gains.

No taxes on withdrawals in retirement.

No required minimum distributions (RMDs) while you’re alive.

There are four caveats I want to mention with ROTH IRA:

You typically need earned income to contribute to a ROTH IRA.

There is an income limitation to contribute.

The max contribution to a ROTH IRA in 2025 is $7,000, or $8,000 if you are 50 or older.

You need to have funded the ROTH IRA for five years before withdrawing any earnings—even after you've reached age 59½—or you could owe taxes.

The ROTH 401(k)

The ROTH IRA was such a hit that it eventually inspired its workplace cousin, the ROTH 401(k).

Introduced in 2006, the ROTH 401(k) combines the best of both worlds: the higher contribution limits of a traditional 401(k) with the tax-free withdrawals of a ROTH IRA.

Unlike ROTH IRAs, which have income limits that prevent high earners from contributing directly, ROTH 401(k)s are open to everyone as long as their employer offers one.

The pros of a ROTH 401(k):

Same ones as the ROTH IRA plus…

Higher contribution limits:

If you’re under 50, you can contribute up to $23,500 in 2025.

You can save an additional $7,500 if you’re 50 or older.

If you’re between the ages 60-63, you can save the $7,500 plus an additional $3,750.

There is no income limitation - which is different from a ROTH IRA which phases out for high earners.

There is a caveat with ROTH 401(k)s:

If your employer offers a match, that money goes into a traditional 401(k) bucket, which means it will be taxed later—but hey, free money is free money.

NOTE: there was an RMD requirement with ROTH 401(k)s, but that provision was eliminated under the Secure Act 2.0.

Done For Now

I didn’t get into the rules behind inheriting a ROTH account, spousal ROTH IRAs, 529 accounts that can be moved to a ROTH IRA, the backdoor ROTH IRA, or other special situations.

Look out for a Part 2 in the future.

One thing is true: ROTH IRAs and ROTH 401(k)s offer some of the best tax advantages in the retirement savings world.

Use them to your advantage.

Plan for the future because that’s where you’re going to spend the rest of your life.

- Attributed to Mark Twain

Now here’s what I’ve been reading and watching lately:

The story of Jim Simons (the man who generated 66% annualized returns) on Founders Podcast

The story of Adidas on Founders Podcast

All the different ways your life could have turned out by Morgan Housel

How To Know A Person by David Brooks

One of favorite children’s book (I have a 5-year old): Maybe by Kobi Yamada

Here’s some of my latest writing: